In a landmark executive action, the U.S. President has signed an order adjusting import tariffs based on reciprocal trade imbalances and national interest objectives. India is one of the countries directly affected, with its reciprocal tariff rate adjusted to 26%, up from previous preferential or MFN levels.

This strategic trade move is aimed at rebalancing trade deficits and incentivizing fair market access for U.S. exporters. The revised tariff framework is backed by an extensive list of over 3,000 product lines under HTS codes across sectors like chemicals, minerals, fuels, and rare metals.

Top 10 Takeaways for Indian Exporters:

-

India’s new tariff rate for exports to the U.S. is set at 26%

-

The action is part of a reciprocal tariff realignment with 70+ countries (Annex-I), many of whom face similar hikes. No exemptions for developing countries – Vietnam, Sri Lanka, and Bangladesh are all included.

-

‘Reciprocal Tariff Adjustment’ is not uniform – countries like Lesotho face 50% while others like Nigeria see 14%.

-

The implementation of the order will be on April 05, 2025 – 12:01am Eastern Daylight Time with an initial levy of 10% and the full rate as per the Order (India – 26%) from April 09, 2025 – 12:01am Eastern Daylight Time. Goods already loaded onto a vessel at the port of loading and in transit on the final mode before the specified timing but land after the date shall not be subject to these new ad valorem rates of duties.

-

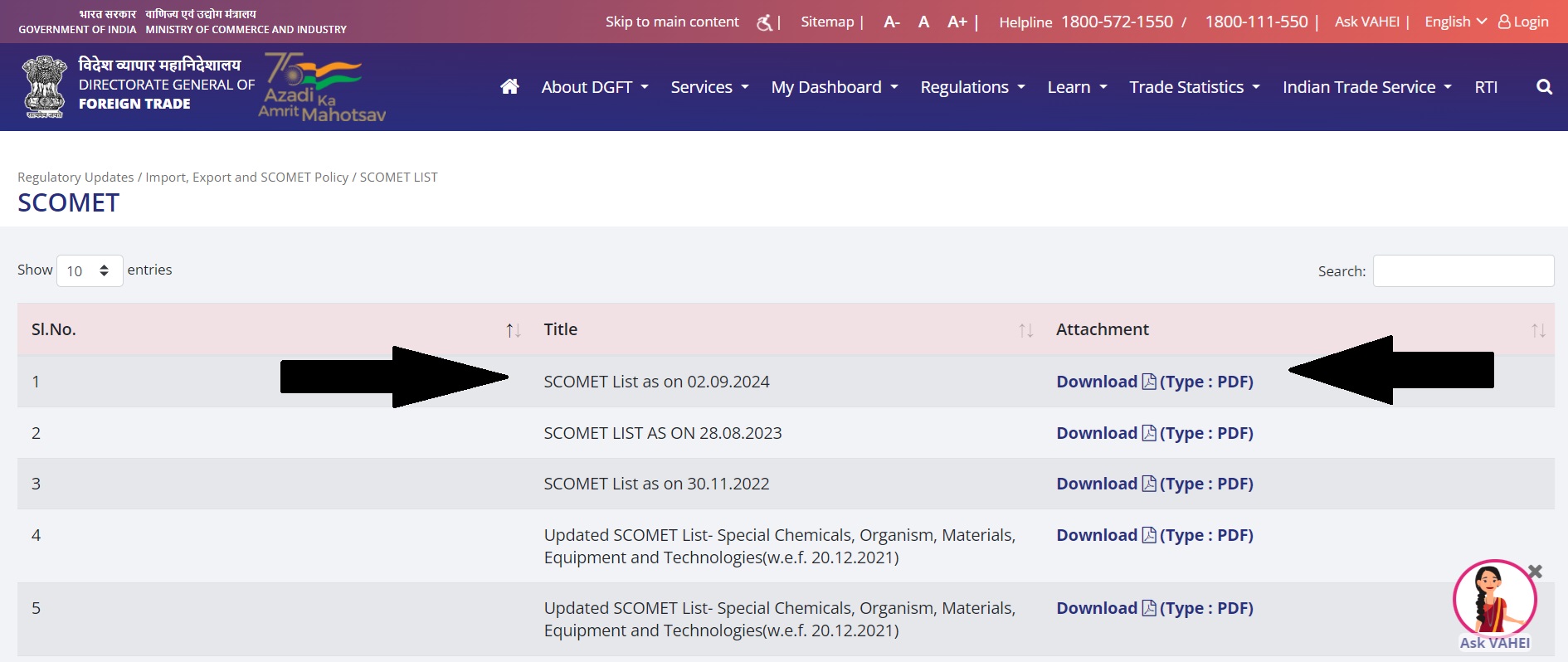

Annex II lists product that are excluded from the ad valorem tariffs under this order. Excluded products include copper, aluminum, bauxite, fluorspar, graphite, APIs, and many chemicals.Exporters must validate their product’s HTSUS classification against Annex II to assess the exemption.

-

These goods may face separate or alternative duty treatment, yet to be announced.

-

The rates of duty established by this order are in addition to any other duties, fees, taxes, exactions or charges as applicable to such imported articles, except as provided in the exemptions of the order.

-

In order to establish the duty rates described in the order, the HTSUS is also modified as set forth in the Annexes to this order. The modifications will take effect on the dates as mentioned in the order. Exporters can refer to https://hts.usitc.gov/ for further details.

-

Accurate classification of export products under HTS codes is now more critical than ever.

-

This change could significantly impact pricing, margins, and competitiveness in the U.S. market

This tariff realignment by the U.S. President marks a paradigm shift in trade policy, introducing stricter, country-specific import duties aimed at promoting reciprocal trade. Indian exporters must act now – assess your product lines, understand revised tariff rates, map HTS codes, track regulatory updates, and prepare contingency plans for what may come next.

*****

* The Annex I has been updated where rate against India has been edited to 26%

(https://www.whitehouse.gov/wp-content/uploads/2025/04/Annex-I.pdf)